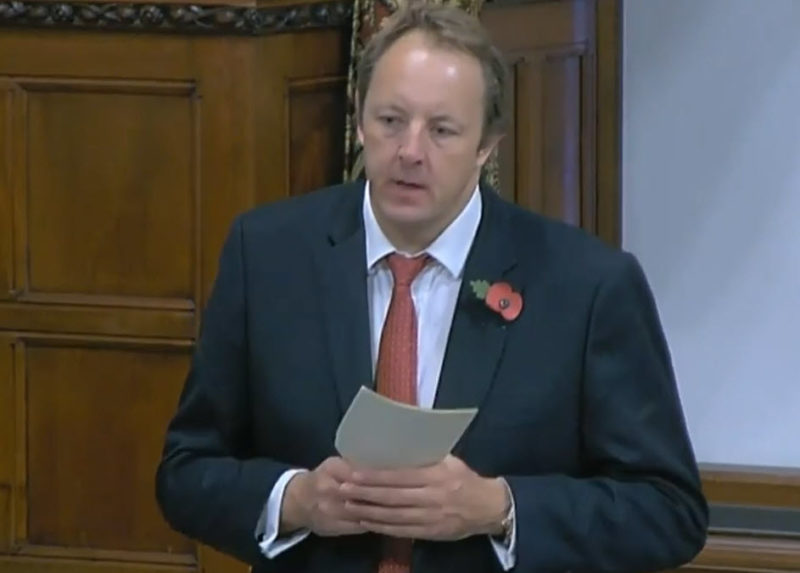

Toby Perkins MP Standing up for Chesterfield and Staveley

Pressure is growing on the car insurance industry to provide refunds or lower premiums to customers to recognise the fall in car use and reduction in claims as a result of the COVID-19 pandemic.

The Government has stated that driving is down by 75% as a result of lockdown, and it is estimated that this has led to 50% less claims on motor insurance policies.

Toby Perkins, MP for Chesterfield, said, “The majority of us are using our cars far less, with many only using their vehicles once a week for shopping. Therefore, the number of accidents has massively reduced, which is estimated may create additional profits of over £1billion for car insurance companies. The big car insurance firms in the United States have pledged to provide hundreds of millions in refunds to their customers and we need the insurance industry here to step up and do the same.”

Toby added, “I had already written to the Association of British Insurers regarding potential refunds and received a very disappointing response that made it clear that the refunds were not being considered at this time. Whenever there are measures taken to reduce accidents, the insurance industry assures us that this will lead to lower insurance premiums, so the industry’s response to this windfall that they have effectively received is revealing. I am still waiting for a reply from the Treasury on this and I will be pressing the Government to take action if the industry won’t.

We have also seen insurers refuse thousands of ‘Business Interruption’ claims from businesses affected by the pandemic and it feels to me that the insurance providers are focused on protecting themselves rather than their customers.”